straight life policy calculator

Straight life policy formula Friday June 10 2022 Edit. A straight life policy will build cash value over time as you continue to pay your premiums.

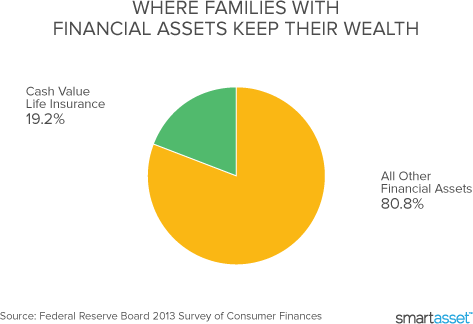

What Is Cash Value Life Insurance Smartasset Com

Use this income annuity calculator to get an annuity income estimate in just a few steps.

. You can use our term life insurance calculator above as a starting point to. This phrase implies that premiums for the plan will remain constant and they will not rise or fall over the duration of the policy. Let SelectQuote Find You The Right Coverage.

Because the payouts will be shorter in duration they offer the highest periodic. Most of the life insurance premium calculators follow the below steps to calculate the premium of an insurance plan. Request Free Life Insurance Quote.

Ad Learn More about How Annuities Work from Fidelity. The prospective policy buyer should enter the following details. Trusted By Over 12 Million Families.

Gender of the applicant. The annual income of the applicant. Whole life insurance costs about 5 to 15 times more than a comparable term life insurance policy because it lasts longer and comes with a cash value investment component.

Find Out Now What Your Life Insurance Policy Could Be Worth With Our Free Calculator. This is the amount to be paid by life insurance firms on insurance policiesInsurers consider the applicants age health history self and family driving. Marital status of the applicant.

The cost of life insurance varies greatly from person to person and depends on several different factors. Life Insurance Premium Calculator. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

A policy that provides continuous premiums that remain level for the policys life is known as a Straight Life Insurance Policy. A straight life annuity is a type of annuity in which the annuitant receives payments for as long as they live. A straight life insurance policy can also build cash value over time.

Ad Calculate Your Life Insurance Needs. Get a Quote Today. Other permanent life insurance plans such as adjustable life insurance can have a premium structure that changes over time.

Annuities are one way to make your money work for you and provide a reliable income stream in retirement. Browse Your Options Now. Estimate how much coverage you may need to replace your income and get a quote.

Top Crane Companies Act Top 100 Crane Companies Top Ten Annuity Companies. A straight life policy has a level premiumit wont change over the life of your policy. Straight life insurance is a type of permanent life insurance that provides a guaranteed.

Now Offering New Rates for Smokers and Non-smokers. Ad Smart Customizable Coverage. Trusteed For Over 100 Years.

Learn how each factor can impact the premium you pay for life insurance below. All life insurance calculators tools. Straight life annuities do not include a death benefit so payments cant be made to a beneficiary.

Melissa Toby age 36 bought a straight-life insurance policy for 80000. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest goes to the cash. Ad Term and Whole Life Insurance You Can Rely On.

Ad We Found Jay A 500000 Policy For Less Than 25 Per Month. These policies are more expensive. Number of children of the applicant.

The final cost of your life insurance will be based on a deeper dive into your health information and background. Offer helpful instructions and related details about Straight Life Annuity Calculator - make it easier for users to find business information than ever. The straight life annuity does not have an end date or time and usually pays out monthly quarterly semi-annually or annually.

Select the type of life insurance policy that you have. Find Yours With Us Today. Ad Protect What Matters Most with Term Life Insurance from New York Life.

From 15 A Month. Life Insurance Provides Peace Of Mind Knowing Youre Protecting People You Love. Term Life Insurance Quote Tool.

Age The younger you are the lower your. Enter your policy payout amount and annual premium. Estimate how much coverage you may need to replace your income and get a quote.

Please check out our article on accelerated underwriting if you prefer whole life. Get Your Free Life Settlement. This type of policy can be used as an estate.

Age of the applicant. The term straight refers to the whole life insurance policys premium structure. Request Free Life Insurance Quote.

Most policy types are eligible including term life group whole universal survivorship second-to-die and flexible adjustable premium life policies. I received more money from our policy than originally. Another term for this option is life-only or single life annuity.

A straight life annuity policy may be bought over the course of the. Updated last on January 31 2022. Straight Line Depreciation Calculator With Printable Schedule Best Money Saving Tips Family Money Advertising Costs Straight Line Graphs Gcse Maths Steps Examples Worksheet.

Better known as whole life insurance. 401 k College Planning Estate Planning Financial Planning Getting Ready to Retire Insurance Investing Strategies Investing in Bonds Investing in Stocks Living in Retirement Saving and Spending Saving for Retirement. The life settlement calculator works in seven simple steps.

Our cost calculator shows you term life insurance quotes using a few personal factors and policy features. If youre at least 70 years old and own more than 100000 of life insurance you may qualify for a life settlement. Life Insurance Coverage In 3 Easy Steps.

Straight life policy calculator Thursday March 3 2022 Edit. A straight life annuity is a contract between an insurance company and the annuitant.

Whole Life Insurance Quotes Smartasset Com

Life Insurance Riders Explained Forbes Advisor

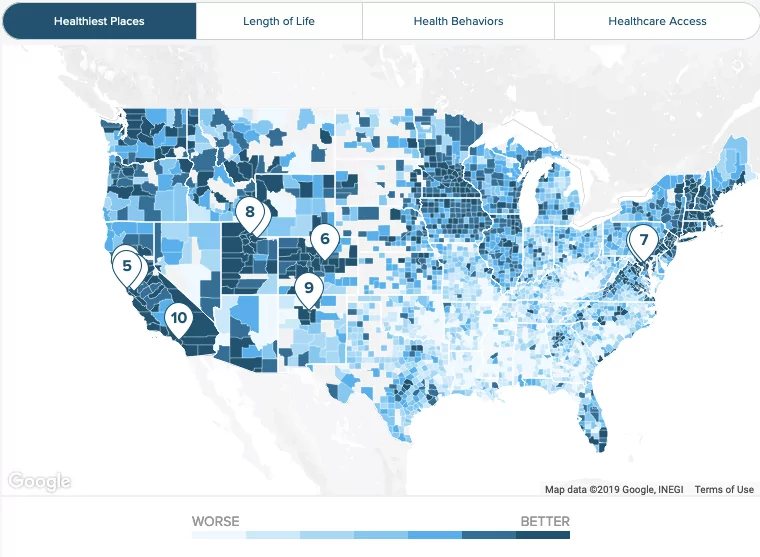

What Is A Straight Life Policy Bankrate

The Best Types Of Life Insurance For 4 Life Stages Credit Karma

What Is Cash Value Life Insurance Smartasset Com

What Is A Straight Life Policy Bankrate

Life Insurance Facts And Statistics 2022 Bankrate

Using Life Insurance As Your Own Bank 7 Actionable Steps You Plan For Today

Loss Ratio Formula Calculator Example With Excel Template

What Is A Straight Life Policy Bankrate

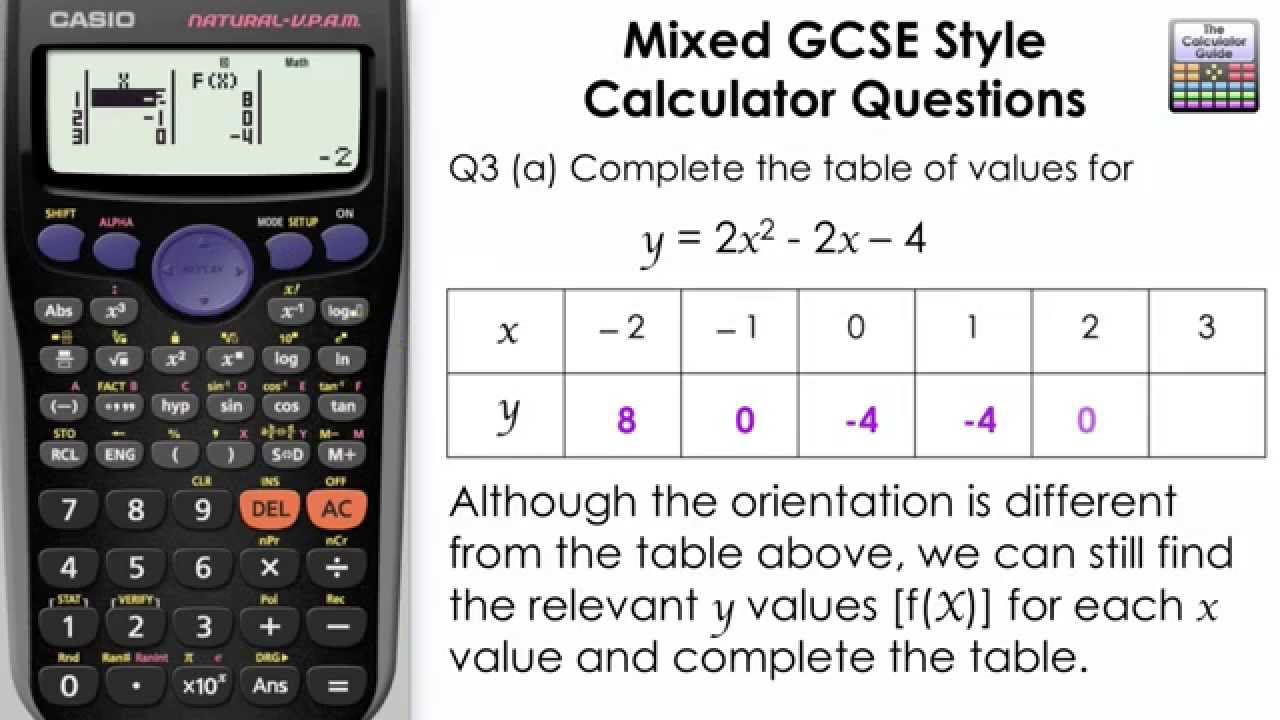

Complete A Table Graph Using Table Mode On Casio Calculator Gcse Maths Fx 83gt Fx85gt Youtube

Double Declining Balance Depreciation Calculator

What Is Whole Life Insurance Cost Types Faqs

Life Insurance Calculator Term And Whole Life Aflac

Download Depreciation Calculator Excel Template Exceldatapro

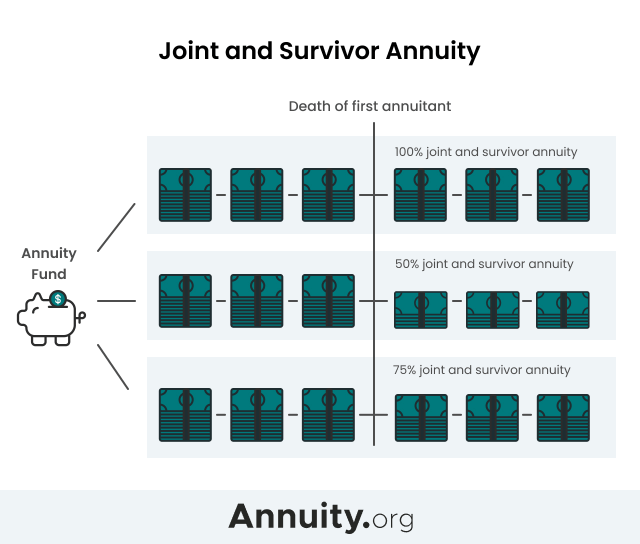

Joint And Survivor Annuity The Benefits And Disadvantages

Download Depreciation Calculator Excel Template Exceldatapro